Fdic Vs Sipc Insurance

Sipc members pay annual premiums into an insurance fund and money held in this fund covers some of your losses if your broker goes bankrupt.

Fdic vs sipc insurance. Federal deposit insurance corporation fdic insurance and securities investor protection corporation sipc offer two different types of coverage that help protect your assets. Securities investor protection corporation just like how the fdic insures bank deposits in the event of a bank failure sipc insures investment accounts in the event of a failure. In broad strokes the fdic is an independent federal agency that protects losses in deposit accounts while the sipc is a nonprofit membership corporation that protects clients of broker dealers that are members of sipc. The sipc is not an agency but a nonprofit membership corporation that was formed by federal statute.

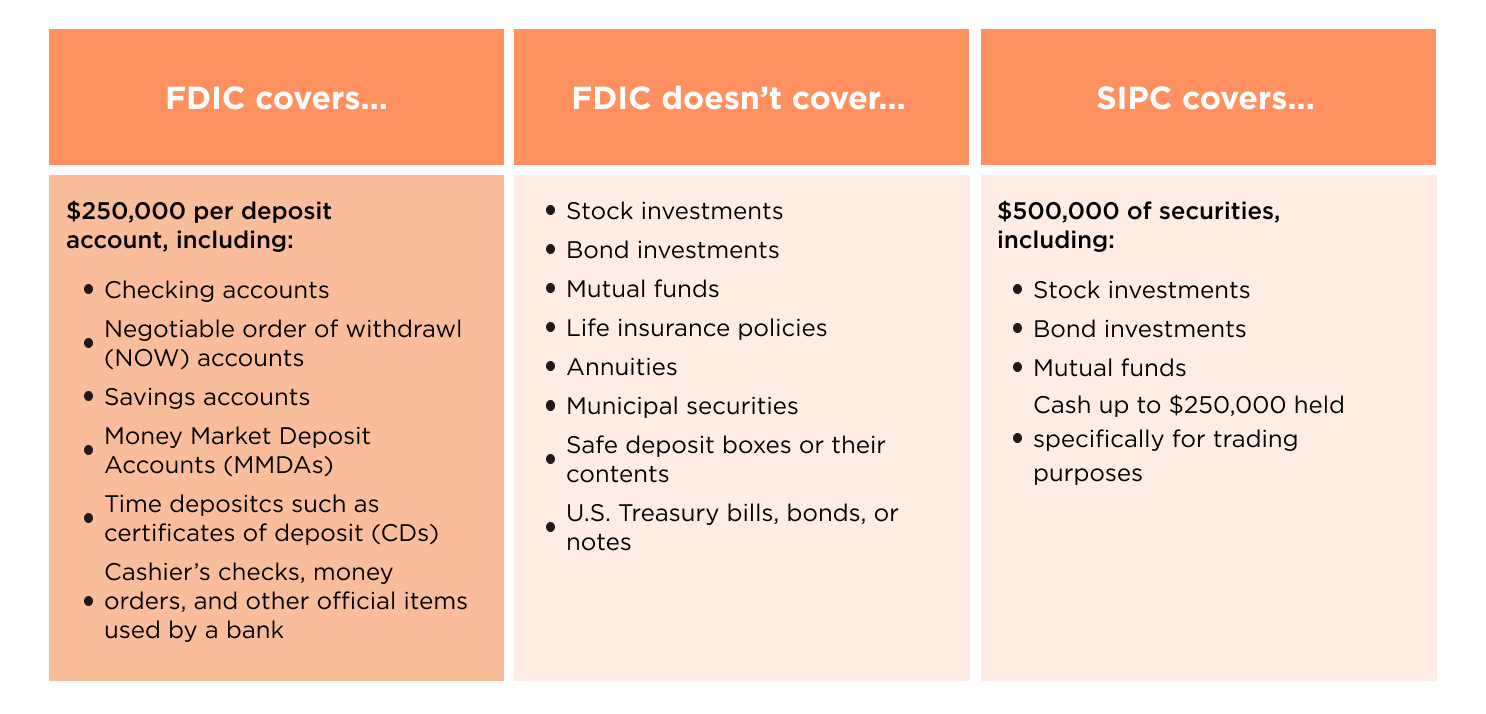

It protects the cash being held in bank accounts up to 250000 per depositor per fdic insured bank. In the case with sipc accounts are insured up to 500000 per account. The federal deposit insurance corporation fdic was created in 1933 with a number of goals the most notable being insurance for your bank deposits. This includes 250000 in cash.

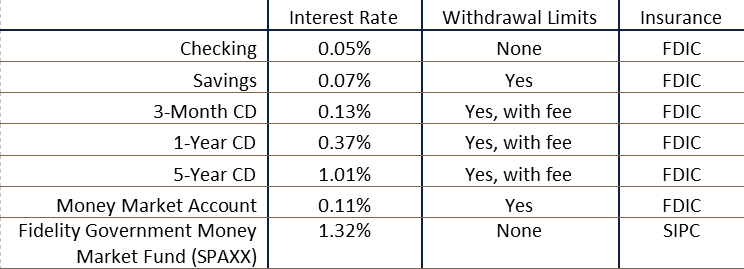

Fdic insurance is the standard deposit insurance offered at most traditional banks for things like checking and savings accounts. Sipc insurance on the other hand protects your assets in a brokerage account. Here are a few key differences between the two entities. The fdic and ncua insure cash thats held in banking products up to a certain amount.

What each one protects. Take a moment to think about all the different types of insurance you currently have. Alexa what is fdic. If your bank has fdic insurance the standard insurance amount is 250000 per depositor per insured bank for each account ownership category.

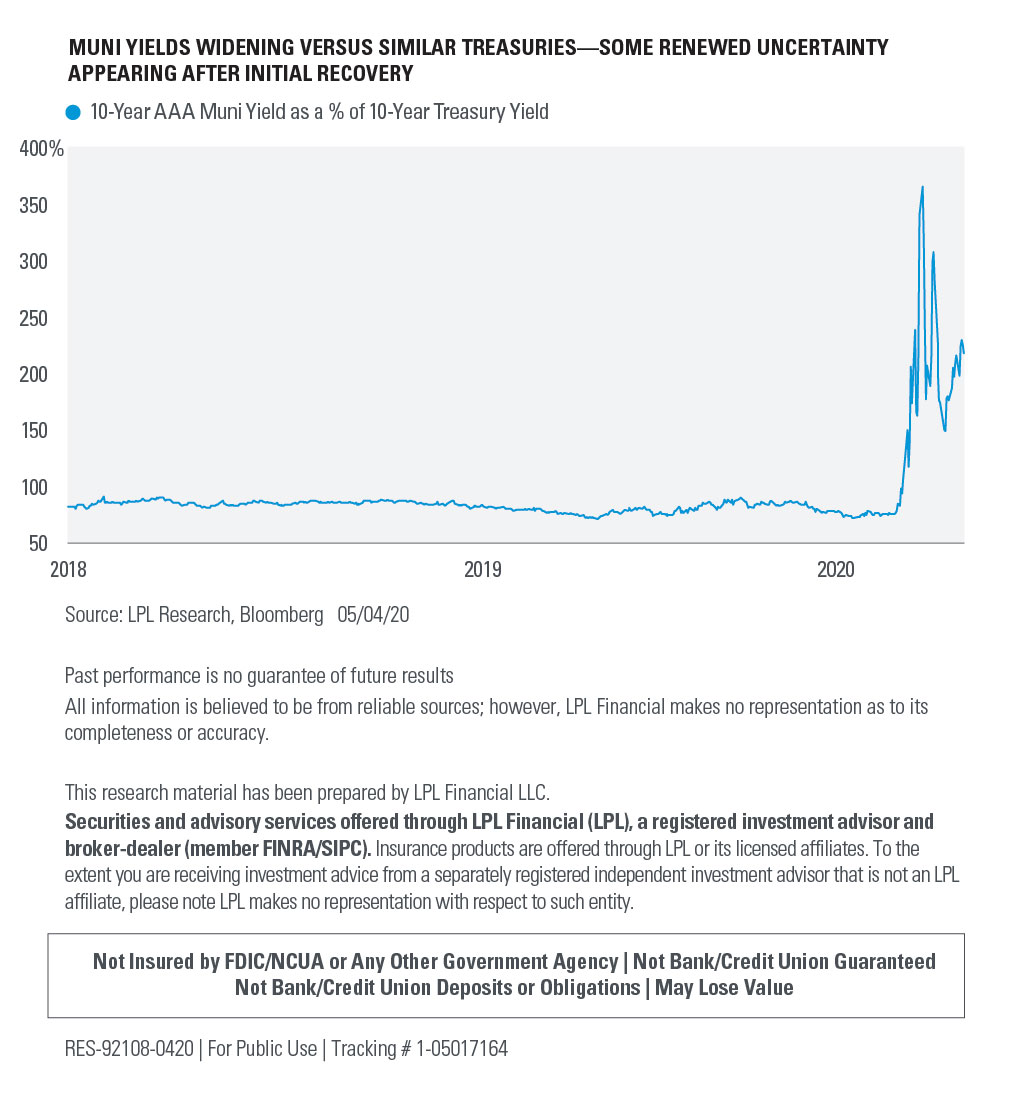

Fdic insurance and sipc coverage protect bank and brokerage firm customers respectively against the risk of failing financial institutions. Fdic and sipc insurance coverage. Fdic insurance does not cover investments in stocks bonds mutual funds life insurance policies annuities municipal securities or money market funds regardless of whether the bank that holds the investments is fdic insured. Fdic insurance protects your assets in a bank account checking or savings.

Sipc on the other hand aims to protect up to a certain amount of losses if your brokerage firm fails. As with the fdic the sipc insures your brokerage account for up to 250000 per account owner. The federal deposit insurance corporation ah there it is was founded in 1933 as an independent agency of the us. Sipc insurance covers assets and cash in a brokerage account up to a certain amount.

/wealthfront-vs-charles-schwab-intelligent-portfolios-dc8b708347dc461fb7dd0970a48de0c3.jpg)

/wealthfront-vs-td-ameritrade-essential-portfolios-072e85eb93f449cab08317a9625d8776.jpg)

/personal-capital-vs-vanguard-personal-advisor-services-4dad1d34084c4780aec788ace455b4a3.jpg)